When the NFT market started a downward trend, many started asking, “Are NFTs dead?” The NFT crash left everyone shocked and investors speechless at the losses they suffered. The decline of NFTs and crypto, in general, is also heartbreaking news, as it diminishes the hope of having an alternative digital market that NFTs held.

But why did the NFT market crash? When will it bounce back? In this article, we analyze why the NFT market crashed and discuss the future of NFTs. But first, let’s have a brief overview of Non-Fungible Tokens.

What is a NFT?

Non-Fungible Tokens (NFTs) are virtual identities or virtual tokens. They can be the digital representation of physical items such as art, monuments, properties, and others. NFTs give people ownership over the products through the use of the blockchain.

Although NFTs have been in existence since about 2014, they only rose to worldwide popularity in 2017. Technically, NFTs can be described as non-interchangeable units of data stored on the blockchain. The data cannot be replicated, destroyed, or tampered with.

The blockchain can validate NFTs and give them an extrinsic value. Some of the most popular types of NFTs are collectibles, digital artwork, event tickets, domain names, and ownership records for physical objects.

The NFT Crash

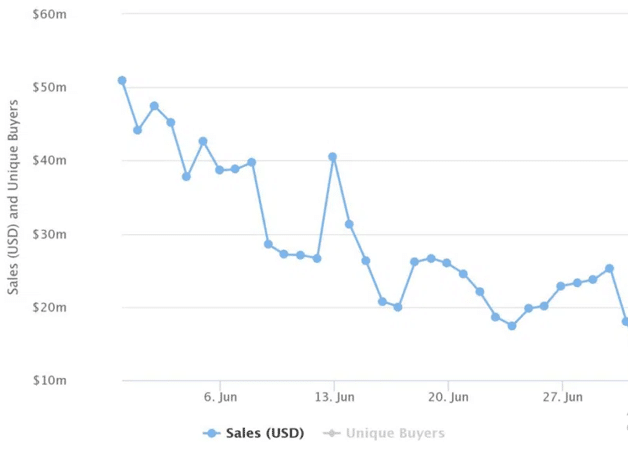

The NFT market crash started in February 2022, with NFT prices declining sharply by the end of the year. This was a shock to many as the NFT market had shown tremendous growth, and some of the NFTs had fetched millions of dollars in prices. Unfortunately, the NFT market dropped, raising many doubts and questions among the people.

The following are some of the stats that indicate that the NFT market has declined:

- An 80% decline in the value of NFTs.

- An 88% drop in the trading volume on NFT platforms.

- A 93% drop in year-over-year sales of Gods Unchained and Axie Infinity.

- A $2 billion decline in the market cap of the Bored Ape Yacht Club (BAYC).

- A sharp fall in NFT sales by $1.6 billion worldwide in the third quarter of 2022.

The NFT crash meant huge losses for investors, collectors, and organizations involved in NFTs.

What Caused the NFT Crash?

While the crypto winter or the crypto market decline is one of the key reasons that caused the NFT crash, it is not the only reason that caused the decline. NFT and crypto experts have observed the reasons that saw the NFT market crash. Let us explore some of these reasons:

#1: Crypto Volatility

The fall in cryptocurrency prices is one of the main reasons that led to reduced investor confidence and interest. There is a strong correlation between cryptocurrencies and NFTs, and the NFT market depends on crypto in some way. For instance, most NFTs are bought and sold in crypto. Thus, it is true to say that the valuation of NFTs is dependent on crypto.

The crash has also created other problems, such as layoffs in the blockchain and Metaverse companies. The volatility and decline in the value of NFTs affected many big companies, such as Blockchain.com, which announced employee layoffs. This also had a ripple effect on NFT-based companies such as Gary Vee-backed Candy Digital and Magic Eden, who went ahead to announce huge layoffs.

#2: Cybersecurity Issues

One of the major challenges facing NFTs is the lack of trust by investors in the safety of digital assets. Although NFTs are known to be secure, the rise in NFT scams has created doubts among collectors and investors regarding their security.

Chronicles, a blockchain analysis company, predicted that NFT scams will rise during the crypto crash. The number of NFT scams also increased between the 1st and the 2nd quarter of 2022. This affected the trust of investors and collectors.

#3: Inflated Market

The inflated or overvalued NFT market is also another reason behind the fall in non-fungible token transaction volume. This is according to Ethan McMahon, an economist. A clear observation of the NFT market trend over the past 2 years clearly reveals that NFTs had a highly hyped promotion.

For example, artist Beeple sold his piece of art as an NFT for $69 million at an auction. Artist Pak also sold his NFT, The Merge, for $91.8 million, making it the most expensive NFT ever sold. NFTs from blue-chip collections such as the CryptoPunks and the Bored Ape Yacht Club were sold for millions of dollars. For more information about the most expensive NFTs ever sold, read this blog.

Non-Fungible Tokens were also endorsed by celebrities. Justin Bieber, Elon Musk, Tom Brady, and Madonna are some of the celebrities who took part in promoting NFTs. This type of publicity pushed the value of NFTs to greater heights at an unfeasible rate.

As a result, the NFT market experienced impulse purchases, overabundance, and unregulated hype. These factors led the quick-moving market to a quick NFT crash. It is easy to think the NFT market crash is making up for earlier overvaluation that NFTs enjoyed.

#4: Economic Cycle

Many NFT experts think that the NFT market crash is similar to the other market declines. There have been hikes in oil prices, recessions, and other events in the world. Every market has its ups and downs, and the NFT market is no exception. So, the NFT market decline may improve in the future.

#5: Wash Trading

Wash trading is another factor that contributed to the 2022 NFT crash and has caused overall volatility in the NFT and crypto sectors. Wash trading occurs when a person or an entity purchases an asset, like crypto, NFT, or stock in a company, and re-sells it to themselves to artificially inflate the price of the asset, which can be sold to a new buyer.

Although wash trading is illegal in securities such as bonds, stocks, and ETFs, there is no such protection in the crypto and NFT markets. Some argue that there is a possibility that NFTs could not have reached anywhere near their peak prices without wash trading.

In one instance, Chainalysis, a blockchain analysis firm, found out that one extremely prolific NFT trader bought NFTs and sent them to more than 830 “self-financed addresses. Although wash trading may inflate NFT prices, the prices decline sharply since the overall market sentiment does not support the inflated price. This can take weeks or months from the initial sale to the victims.

Impact of the NFT Market Crash

The NFT crash has impacted different sectors and stakeholders involved in it. Before the NFT market crash, NFTs were trending globally, capturing the attention of celebrities, sportspersons, artists, and big retailers.

However, the NFT industry is putting effort to restore customer trust that was caused by FTX’s failure and cryptocurrency decline. The NFT crash has made investors lose confidence in NFTs, which may take some time to rebuild.

The NFT crash has also dented the hope of creators. NFTs and the blockchain were seen as the best way for artists to showcase their work to a wider audience. With NFTs, artists don’t have to rely on third parties to connect with their customers. Artists also got substantial monetary benefits by selling their work as NFTs. The NFT market crash has made artists lose the hope they initially had in NFTs.

However, the NFT crash has taught collectors and creators to be cautious about digital assets and to understand market volatility.

Despite the NFT Crash, NFTs have a Bright Future

Although NFTs have encountered a setback, their future is incredibly bright. Grandview Research data shows that the global NFT market will rise to $211 billion by 2030, which surpasses the current size of the video gaming market and the market caps of various Fortune 500 companies.

Play-to-earn NFT games are also rising in popularity, with more developers creating blockchain-based games and major gaming studios exploring how to incorporate NFTs into their existing products. This will increase the sales volume and market cap of NFTs in the future.

Additionally, the use of NFTs in gaming, digital art, and entertainment may become a norm in the coming years. Ordinary documents and assets such as deeds to homes, driver’s licenses, and event tickets may become NFTs. The growth in Layer 2 blockchain networks such as Polygon, plus the rapid growth of Layer 1 blockchain networks such as Solana will give NFTs additional features and utilities. This will bring asset diversity into the NFT market and stabilize the prices of NFTs.

Buy and Sell NFTs for a Profit

You can grow your crypto earnings by buying NFTs and selling them for a profit. NFTCrypto.io has made this even easier for you via their NFT signals trading system. They find profitable flips in the NFT market and share the signal with you in real-time. Join NFT Signals now and become a successful NFT trader. The platform users have so far earned a total group profit of over $1 Billion.