The buzz about NFTs has seen digital assets hit the headlines severally. NFTs, which are essentially tokenized JPEGS, have fetched millions of dollars in prices over recent years. So, why are NFTs so expensive?

Most people would give this simple answer: Because NFTs are art, and art is extremely valuable.

However, it’s not that simple. Profile picture (PFP) NFT projects such as the CryptoPunks and the Bored Ape Yacht Club (BAYC) have been sold for eye-watering prices on the open market. These cannot be accurately characterized as art and art alone. So, why are some NFTs so expensive? Let’s find out why are NFTs so expensive.

What is an NFT?

An NFT (Non-Fungible Token) is a cryptographic asset stored on the blockchain that represents a unique and intangible digital asset such as a photo, a piece of art, a tweet, or an in-game collectible that cannot be replaced with other assets because of its exceptional properties. Each NFT is unique and has a limited supply and is not interchangeable, and it can act as a proof of ownership or authenticity, the major reason artists are considering learning how to create NFT.

Non-fungible tokens are distinguished from each other by metadata and unique identifiers like a barcode. The information that makes up the asset is called metadata. With metadata, users can buy and sell assets based on their metadata rather than the entire asset.

The goal of NFTs is to replicate the tangible attributes of physical objects such as scarcity, uniqueness, and proof of ownership. Fungible goods on the other hand can be exchanged because they are characterized by their worth, not unique features.

As more and more people learn how to create NFT, their use cases also continue to rise. They have expanded from general use cases such as games and digital art to music, fashion, academia, patents, tokenization of real-world objects, loyalty programs, and membership sales.

Why are NFTs So Expensive?

The following are the factors that make NFT art so expensive:

#1: Why are NFTs so Expensive: Scarcity and Rarity

After buying an NFT artwork, you are not simply buying an image but also a permanent token stored on the blockchain unique to that particular digital asset.

Once an NFT creator mints an NFT artwork, it helps them to limit its supply, creating rarity which inflates the NFT’s price.

Additionally, some NFTs are only created for collectibility.

The Bored Ape Yacht Club (BAYC) for example, is an NFT project created as a limited collection. Bored Ape cannot add new collectibles to the original Bored Ape NFT collection.

The CryptoPunks NFT collection comprises 10,000 unique CryptoPunks. Each punk combines the same types of attributes, that is, hair, skin color, and eyes, some of the attributes being rarer than others, making some NFTs so expensive than others.

#2: Why are Some NFTs So Expensive than Others: The NFT Bubble

When traders rapidly buy assets to sell them later at higher prices, it pushes the price of the assets up and creates a bubble.

Celebrities also fueled the hype surrounding NFTs. Celebrities such as Paris Hilton and Lebron James even released their own NFT collections. As a result, many people started investing in NFTs without having a full understanding of the asset, most of them hoping to sell them for a profit.

#3: NFTs can be used to Raise Funds

NFTs can be sold for higher prices when used to raise funds. For instance, one of the greatest NFT sales happened in 2022 when Assange DAO sold Pak’s clock NFT for 16,953 ETH, or about $52.7 million then.

The proceeds from the sale were channeled towards the legal defense of Julian Assange, the WikiLeaks founder.

#4: Why are NFTs so Expensive: Connection with the Metaverse

Another reason why are NFTs so expensive is their connection with the metaverse, which is a virtual world where people can create and use various in-game items. In the metaverse, people are represented as avatars and they can own digital space as virtual real estate. The avatars are sold in the form of NFTs.

Examples of metaverse games are Axie Infinity, Battle Infinity, and others.

As participation in the metaverse increases, the demand for non-fungible tokens will also rise. This anticipated rise in demand for digital assets motivates people to purchase NFTs to benefit in the future.

#5: NFTs are easy to buy and sell

Trading collectibles such as antiques, baseball cards, and stamps can have a steep learning curve. You must have the collectible item authenticated, its condition checked, compare prices, and market it to get a good price.

You may also need some special knowledge to market and store the item. It can also be costly.

However, NFTs are easier to buy and sell. This has been made easier by NFT marketplaces. Anyone globally can easily buy or sell an NFT. This translates to more trading activity, more capital, and raising the NFT value.

#6: Transparency and ownership history

The recorded ownership history of an NFT can affect its value. While tracking the ownership history of a physical art is difficult, it is easier for an NFT.

This has been made possible by blockchain technology. Monitoring ownership is simple because each sale is recorded on the blockchain.

Additionally, in case the NFT was once owned by a celebrity, its price will move up. For example, artist Eminem bought an NFT in December 2021 and used it as his Twitter profile picture. If he decides to sell the NFT, its price will surge.

How Much NFTs Are Worth Now?

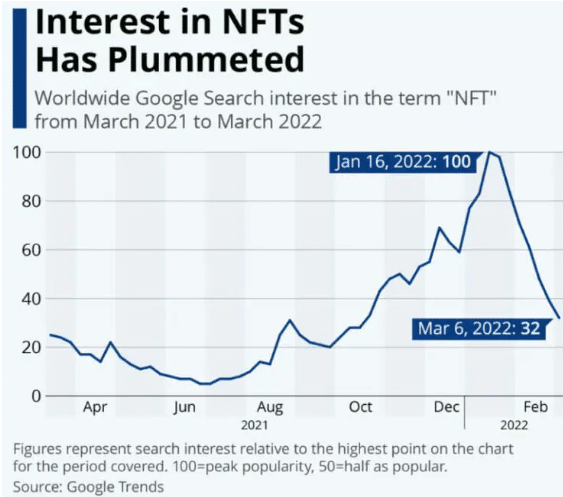

NFTs cost differently, with their prices ranging from a few dollars to millions. In 2022, the average price of an NFT was around $150. NFT prices were at their peak in January 2022, but the interest in NFTs declined sharply after the start of crypto winter. The following NFT value chart demonstrates this:

NFTs recorded the lowest values in September 2022.

However, the NFT market has shown signs of recovery in 2023. In January 2023, NFT market sales climbed 16% higher, with NFT buyers increasing by 43.48% in the third week of 2023. Ethereum was leading in terms of NFT sales. In February 2023, NFT sales volume soared to levels not seen since the start of crypto winter. The data was shared by DappRadar. The total NFT trading volume surpassed $2 billion, which was a 117% increase from the January NFT sales.

Such figures are an indication that the NFT market is recovering from the effects of the crypto winter and that most NFTs will see a surge in their values in 2023.

At the time of writing, some of the top selling NFTs were CryptoPunks with a floor price of 51.50 ETH, Bored Ape Yacht Club with a floor price of 48.40 ETH, and Mutant Ape Yacht Club with a floor price of 10.70 ETH.

Also, read our blog about the most expensive NFTs ever sold.

Buy and Sell NFTs for a Profit

You can grow your crypto earnings by buying NFTs and selling them for a profit. NFTCrypto.io has made this even easier for you via their NFT signals trading system. They find profitable flips in the NFT market and share the signal with you in real-time. Join NFT Signals now and become a successful NFT trader. The platform users have so far earned a total group profit of over $1 Billion.