Introduction to Forex Swing Trading Signals

Swing trading is a strategy in Forex where traders aim to profit from price fluctuations. However, success in swing trading forex depends on more than just spotting price swings. Traders must also consider the right indicators, timing, and risk management strategies.

Whether you’re new to Forex or an experienced trader, swing trading is a viable approach. To use it effectively, you need to grasp its principles and explore various strategies that can help you consistently earn profits.

If you’re a Forex trader practicing the swing trading technique, you’re probably keen on finding reliable signals. In this article, we’ll discuss some of the best swing trade signals for Forex in 2023. But first, let’s understand what swing trading entails.

What are Forex Swing Trading Signals?

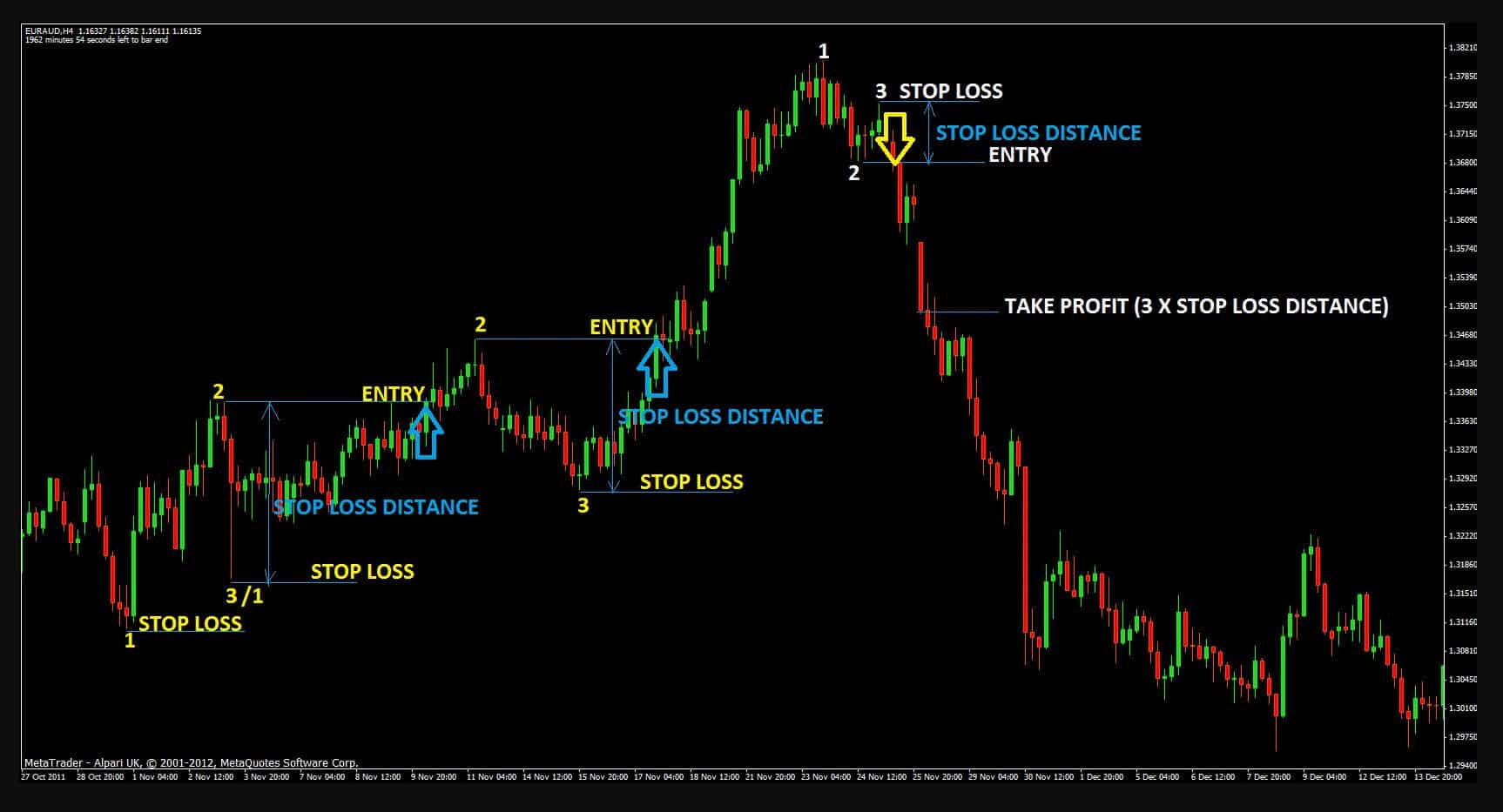

Swing trading is a short-term strategy where traders buy or sell currency based on technical signals indicating a potential price change. These price swings can happen over days or weeks, not just in a straight line.

Swing traders rely heavily on technical analysis to track currency movements and pinpoint moments when a market swing might occur. They aim to enter and exit trades at these turning points, known as “swings.” This approach focuses on capturing short-term forex trading signal opportunities within longer-term trends. Traders spot potential trends and hold their positions for several days or even weeks.

Join our Telegram Channel Today, and Start making Big Profits

Join Now

To make precise trading decisions, traders use the best indicators. These indicators help them spot various opportunities and simplify their trading process. Swing trading falls between day trading and position trading. It’s ideal for traders with full-time jobs who can spare some time to keep an eye on market trends and stay updated.

Best Time Frame for Swing Trading Signals

The choice of the best time frame for your swing trading strategy is flexible and personal. With this approach, you decide when to trade based on your analysis of market trends. While some suggest entering the market at its opening, you have the freedom to choose a time that suits your preferences and circumstances.

Why use a Forex Swing Trading Signals Strategy?

In swing trading, the goal is to make larger profits compared to day trading. However, it’s essential to remember that swing trading, like any trading approach, doesn’t guarantee profits. Traders must exercise caution and make informed decisions when trading.

Best Free Trading Signals Provider 2023

nftcrypto.io

nftcrypto.io is your top destination for finding leading trading signal service providers. Our experts are highly experienced and meticulously select providers that offer quality trading signals with clear entry and exit points, risk management strategies, and efficient delivery.

NFT Signals is your go-to resource for both new and experienced traders looking to profit from NFTs. We make NFT trading easy by providing clear buy and sell signals, along with valuable insights from our expert traders.

Our mission at NFT Signals is to simplify NFT trading. We share NFT signals through Telegram and Discord, so you’re always in the know. Our friendly team is here to assist you, answering questions and solving any issues you encounter.

The best trading signal providers deliver fast, reliable, and frequent signals. It’s essential to choose a provider that offers consistent signals for optimal performance. For outstanding performance, frequent signals, and a wide range of options.

We’ve created an innovative NFT trading signal system that delivers at least 5 signals each week. This is your chance to learn from seasoned NFT traders with a proven track record. You’ll also receive five carefully selected NFT trading alerts weekly, which can be a great aid in your learning journey.

Say goodbye to endless internet searches. NFT Signals is your one-stop solution. We offer straightforward, easy-to-understand information, so you can dive into the world of NFTs and make the most of their potential. Everything you need is right here, ready for you to explore and enjoy!

Join our Telegram Channel Today, and Start making Big Profits

Join Now

Oscillators and Trend indicators for Forex Swing Trading Signals

Oscillators

Some indicators, called oscillators, come before price movements. They give us a heads-up to enter or leave the market before prices change. In simple terms, they predict price shifts. For many Forex traders, these leading indicators or oscillators are great because they offer signals before the price moves. An oscillator signals that the market is “overbought” and tells you to sell. However, the price keeps going up.

To avoid these false signals, traders often use more than one oscillator in their strategies. They wait until both indicators give a signal before making a trade. This helps reduce the chance of getting fooled by fake signals. Two widely used and strong oscillators are the stochastic and the RSI. Many strategies mix these two indicators. You can also use them together in your swing trading plan. Let’s explore how they function.

Stochastic indicator and How it Works?

The stochastic indicator is highly popular among traders in financial markets because it’s easy to understand. It helps us spot when a currency pair’s price is either too high (overbought) or too low (oversold).

It’s called a “leading indicator” because it warns us in advance when a currency pair’s price might change direction. In other words, it gives us a heads-up about possible price changes, offering trading opportunities. The stochastic indicator consists of two lines that move together and interact with each other. It also has two zones: an upper one (overbought) and a lower one (oversold).

When both lines enter the lower zone, the stochastic gives us a signal that the currency pair is oversold. In this situation, we might consider buying the pair when the two lines cross upwards, moving out of the oversold zone. Conversely, if both lines enter the upper zone, it suggests the currency pair might be overbought. In this case, we can think about selling the pair when the two stochastic lines cross downwards, moving out of the overbought zone. These are the basic signals the stochastic oscillator provides. However, stochastics are also valuable for spotting divergences.

When you analyze with stochastics, you might notice a situation where the indicator goes up while the price goes down, or the opposite (price up, stochastics down). These are called bullish and bearish divergences. A bullish divergence between price and the stochastic suggests a potential price increase. Conversely, a bearish divergence hints at a possible price decrease.

RSI indicator and How it Works?

The Relative Strength Index (RSI) is another valuable stock market indicator, widely used by traders worldwide. It shares similarities with the Stochastic Oscillator as it helps identify overbought and oversold conditions and highlights divergences. Unlike the Stochastic, the RSI consists of just one line that moves within the upper and lower regions, representing overbought and oversold areas.

When the RSI line enters the upper zone, typically above the 70 level, it signals that a market is overbought. This suggests it might be a good time to consider selling the currency pair. Conversely, when the RSI line dips into the lower zone, usually below 30, it indicates an oversold condition. This could be an opportunity to consider buying the currency pair.

RSI divergences work similarly to those of the Stochastic Oscillator. Sometimes, you’ll notice differences between the price’s highs and lows and the RSI’s movements, leading to bullish and bearish divergences. A bullish divergence often hints at potential upward price movements, while a bearish divergence suggests possible downward price movements.

Trend Indicators

These indicators are known as lagging indicators because they signal us to invest after the price has already shown its move. In simpler terms, they confirm what’s already happened instead of predicting future movements. However, lagging indicators come with an advantage: they tend to produce fewer false signals compared to leading indicators. On the flip side, their drawback is that they provide reversal signals later, after the price has already started its move. This means you might miss out on a portion of the price movement.

Now, let’s take a look at some of the most commonly used trend indicators in the stock market: MACD, Bollinger Bands.

Join our Telegram Channel Today, and Start making Big Profits

Join Now

MACD and How it Works?

Many traders consider the MACD (Moving Average Convergence Divergence) as one of the best indicators in the Forex market. It’s incredibly popular among Forex traders. The MACD works by taking two moving averages of the price and then smoothing them out with two more moving averages.

Besides the two moving averages, the MACD also has a histogram. This histogram reveals the difference or distance between those two moving averages. Similar to other trend indicators, the MACD operates on a relatively longer time frame to signal reversals. Nevertheless, it remains one of the most widely used and effective technical indicators in trading.

Bollinger Bands and How it Works?

Bollinger Bands are an indicator that focuses on price volatility. They consist of three main components: an upper line or band, a lower line or band, and a simple moving average. These bands serve as levels of support and resistance for price movements. Traders often use the simple moving average as a point of entry into the market, although the specific approach can vary depending on the trading strategy. When the two bands are close together, it suggests that the currency pair is experiencing low volatility. Conversely, when the bands start to widen, it indicates that the currency pair is in a period of higher volatility.

Swing Trading Pros and Cons

Pros

- Swing trading doesn’t require constant trend monitoring since trades can extend over weeks. It’s a good fit for Forex traders who work full-time jobs.

- Unlike day trading, swing trading tends to be less stressful. It leans on technical indicators for trading decisions.

- The strategy can be profitable; an average trader may earn a 2% profit per trade.

Cons

- To succeed in swing trading, you should be able to quickly learn how to accurately analyze charts.

- It’s important to be aware of overnight risks when swing trading. Since you can’t monitor charts 24/7, you might occasionally miss exit points.

Conclusion

Swing trading is a popular style in forex. It aims to capture moderate price moves for quick profits while keeping risk in check. Swing signals usually balance risk and reward well, potentially outperforming day trading. However, avoid highly volatile assets to reduce overnight risks, making it suitable for part-time traders.

Trading signal providers such as nftcrypto.io are great for swing trading. They help traders identify price movements swiftly, reducing the work required. In summary, swing trading is a favored method for making profits in forex by capitalizing on moderate price swings while minimizing risks. Trading signals, like those from nftcrypto.io, can simplify this strategy for traders.

Buy and Sell NFTs for a Profit

You can grow your crypto earnings by buying NFTs and selling them for a profit. NFTCrypto.io has made this even easier for you via their NFT signals trading system. They find profitable flips in the NFT market and share the signal with you in real-time. Join NFT Signals now and become a successful NFT trader. The platform users have so far earned a total group profit of over $1 Billion.