Identifying an NFT pricing strategy requires understanding how to set an NFT price with profitability at the top of the mind. Any piece of digital art can be sold for millions of dollars and anyone can make that amount of money with the right strategy. In this article, we discuss how to set NFT prices with profitability and how much you should sell an NFT.

NFT Pricing: What are NFTs and why are they Valuable?

NFTs are digital assets stored on the blockchain and identified by a unique number. This means that NFTs are unique, indivisible, and immutable, and they cannot be destroyed or duplicated. When combined, these qualities make NFTs ideal as proof of ownership tokens for various types of items both in the digital and physical worlds.

NFTs are created through a process known as minting, which involves writing a new unique ID and ownership information for an asset on the blockchain such as Ethereum via a smart contract. The asset can be an image, video, or real-life asset such as a piece of art. Just like cryptocurrencies, NFTs are stored in crypto wallets such as MetaMask and Binance wallet. NFTs are bought and sold on NFT marketplaces such as OpenSea and Rarible.

NFTs get their value from scarcity and the fact they can be bought, sold, and traded. But how do you quantify that value, or determine NFT price, especially after creating a brand new NFT? That is exactly what we will be discussing in the next section.

Factors that Determine NFT Price

In some ways, setting an NFT price is similar to setting the price of any new product before its launch into the market. In other ways, NFT pricing is more similar to pricing a collectible item.

Being the creator, you can set the NFT price that you desire. However, setting a high NFT price means you may never sell the NFT while setting a low NFT price may make it challenging to raise it with time. So, the following are the factors to consider when setting an NFT price:

#1: Costs

If you are starting to sell NFTs, you don’t want to sell them at a loss. That is why you have to calculate the costs of creating and selling an NFT to know the minimum NFT price at which you can still make a profit.

The following are some of the costs you incur when creating and selling an NFT that determines an NFT price:

- Creation costs- You will incur a cost for creating the digital asset itself. For example, you may have to hire a professional 3D artist to create a 3D model.

- Minting costs- Blockchains such as Ethereum require you to pay gas fees to register your work on the blockchain. Gas prices fluctuate from time to time, so you must be mindful of the current gas prices before minting. This determines NFT prices. Some blockchains allow you to mint NFTs for free, but they have a smaller user base.

- Marketplace fees- NFT marketplaces charge you for minting or listing NFTs on their marketplace platforms. Some also charge deposit and withdrawal fees, and these will determine your NFT price.

- Selling costs- Some NFT marketplaces charge selling fees (or fees for every transaction). After listing your NFT on an NFT marketplace, you may have to market it to reach potential customers. You will incur a cost for this, which should be factored in when setting the NFT price.

#2: Rarity

Rarity is one of the major factors that determine an NFT price. Rare NFTs have a higher value than common ones. The degree of rarity is determined by factors such as:

- The asset type- Some assets are more scarce than others. For example, a one-of-a-kind painting is rarer than a digital image.

- The supply- The rarity of an NFT also depends on its total supply, consequently, determining the NFT price. A limited-edition NFT with 10 copies is rarer than an NFT with 500 copies, which will also be reflected in the NFT prices.

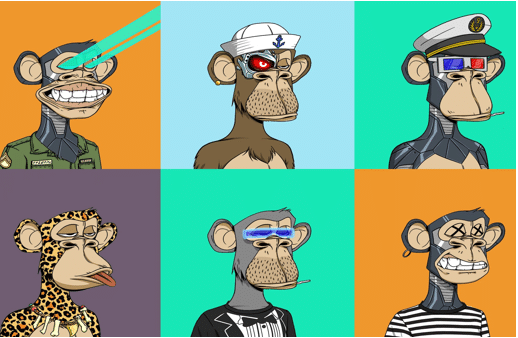

Many NFT collections comprise hundreds of copies of similar-looking images such as the Bored Ape Yacht Club (BAYC).

In such cases, rarity is achieved using traits such as skin color, hair type, clothing, facial expressions, and more. An NFT that features rarer traits will have a higher NFT price than those with common traits.

#3: Functionality

Functionality is an important factor to consider when setting NFT prices. In the cryptocurrency world, for example, utility tokens have more value than non-functional tokens because they can be used by their owners to access services such as subscription-based benefits or free food delivery. This also applies to NFTs since they are powerful business tools.

Many businesses create NFTs with unique features to grant their holders access to special services, get-togethers, events, early access to new products, and more.

When setting the NFT prices for such NFTs, you must put into consideration the cost of providing those services and ensure that you can deliver. For example, if you run a virtual office business, you can create an NFT that gives the holder a free mail consolidation every month for the following year. In that case, the NFT price should offset the cost of doing 12 physical mail consolidations and other costs to be involved.

#4: NFT Prices of other similar NFTs

Finally, you must consider how much the market is willing to pay for other similar NFTs. This will give you an idea about the upper and lower limits when setting your NFT price. Of course, you don’t have to follow the masses. Set the appropriate NFT price depending on whether its value is more or less than other similar ones.

NFT pricing is not an exact science, but considering the above factors, you will be able to set a fair NFT price to help you sell your NFT and make a profit.

Best Method for Setting NFT Prices: Fixed Price or Auction?

Most NFT marketplaces have two options when it comes to setting NFT prices, and some allow users to use both at the same time. Knowing which one is better, fixed price or auction involves knowing how they work as well as their pros and cons.

Fixed Price

This NFT pricing method allows you to purchase an NFT using the “Buy Now” option without having to place a bid or negotiate. Some NFT marketplaces provide the ability to send an “offer” to “accept” or “decline” the purchase. It is a good strategy for setting the NFT price of your affordable NFTs.

Auction

This method of setting NFT prices allows collectors and non-collectors to place bids on your NFT. The auction starts immediately after the first bid is placed and it lasts for 24 hours in its entirety. Typically, the NFT price should be set lower than for the “Buy Now” option because it allows buyers to get your NFT at a discount.

Depending on the option you choose, you will be required to decide on the starting NFT price.

What is NFT Price Floor and Why Does it Matter?

The floor price is an indication of the health of an NFT collection. It is the lowest NFT price for a particular NFT collection. You can use the price floor to determine the NFT price for your NFT. If you set your NFT price at the floor price, buyers feel that you want to sell your NFT quickly.

The simplest way to calculate the NFT floor price is by taking the lowest-priced NFT in a collection. At the time of writing, for example, OpenSea data shows that the Bored Ape Yacht Club has a floor price of 60 ETH because that is the lowest listed price for a BAYC NFT on the marketplace.

How to Set your NFT Price and Make a Profit

Below are the steps to follow to price your NFT and make a profit:

Step 1: Do your research

The first step in setting an NFT price is doing research. Understand the NFT industry better and know the NFT prices of other NFTs. Also, research the various NFT marketplaces that are available and the common types of NFTs listed on their platforms, and their price ranges.

Step 2: Choose an NFT marketplace

NFT marketplaces are different, each having its strengths and weaknesses. Some NFT marketplaces charge higher fees but have a wider audience, while others charge lower fees but have a limited audience. NFT marketplaces also offer different levels of security, with some subjecting their users to strict KYC verification protocols while others are lenient. Choose the NFT marketplace that will help you to meet your goals.

Step 3: Consider the costs

Calculate how much it will cost you to create, mint, list, and sell your NFT on the marketplace of your choice. This will help you know the lowest NFT price that can leave you with a profit.

Step 4: Choose how to sell your NFT: Fixed price or Auction

The simplest way of setting an NFT price is using the fixed price option. However, it only suits NFTs with a defined value proposition. If you are not sure about the value of your NFT or you want to test the NFT market, sell your NFT through auction.

You can add royalties to your NFT and earn income anytime the NFT is sold in the secondary market.

Buy and Sell NFTs for a Profit

You can grow your crypto earnings by buying cheap NFTs and selling them for a profit. NFTCrypto.io has made this even easier for you via their NFT trading signal system. They find profitable flips in the NFT market and share the signal with you in real-time. Join NFT Signals now and become a successful NFT trader. The platform users have so far earned a total group profit of over $1 Billion.