Investment in NFTs (Non-Fungible Tokens) is now a popular way of making money from the blockchain. Tracking the performance of an NFT in relation to other digital assets in the market can help an investor to make sound decisions when trading NFTs. An NFT index helps investors to track the performance of tokens within the NFT industry. In this article, we discuss NFT indexes in detail, including what they are, their types, and how to invest in an NFT index.

What is an NFT Index?

An NFT index refers to a collection of data that tracks the performance of NFTs in the market. NFTs are unique digital assets stored on the blockchain and verified using smart contracts. NFTs represent the ownership of digital content such as art, videos, and other types of creative work.

NFT indexes provide a way of measuring the performance of NFTs as an asset class. Just like stock market indices, the NFT index combines the prices of many NFTs to give an overall value that shows the performance of the group. NFT indexes are good for investors who need to track the performance of NFTs as a whole, instead of just one specific NFT.

A number of platforms and companies have created NFT indexes. Examples include the NFTX Protocol, which facilitates the creation and trading of index funds, and the NFT20 Platform, which enables investors to trade NFTs as tokens on the Ethereum blockchain.

The NFT indexes provide insights into the market trends of NFTs and they can help traders to make sound decisions when trading NFTs.

What is an NFTs Index Fund?

An NFT index fund gives investors exposure to a diversified portfolio of NFTs. NFT index funds are similar to traditional index funds since they allow investors to invest in a wide range of assets with a single investment.

An example of an NFT index fund is the NFTX protocol. NFTX has created many index funds for tracking different categories of NFTs, including gaming, arts, and sports. Investors can buy shares in these funds via ETH or other cryptocurrencies.

Another example of an NFTs index fund is the Metaverse Index Fund provided by Bitwise Asset Management. It tracks a range of cryptocurrencies and companies involved in building the Metaverse, a virtual reality space powered by the blockchain. The fund involves blockchain-based assets such as NFTs.

Just like other types of investments, it is good to do your own research before investing in the NFT index funds. This will help you know the risks that are involved. NFTs are a new asset class, and the NFT market is still under development, meaning you should expect a lot of volatility and uncertainty compared to more established asset classes.

What is the Metaverse Index Fund?

The Metaverse Index Fund is an index for tracking the performance of a basket of Non-Fungible Tokens used in the metaverse. The metaverse is a virtual space powered by the blockchain. The metaverse is described as a fully immersive virtual world where users can interact with each other and with digital assets in a 3D environment.

It is provided by Bitwise Asset Management, a crypto investment firm that manages many cryptocurrency index funds. The index tracks NFTs related to the metaverse, like digital avatars, virtual real estate, and other virtual items used in the metaverse.

The purpose of the index is to provide investors with exposure to the growing metaverse ecosystem, which is expected to become an important part of the digital economy in the future. As the metaverse continues to grow and more people join the virtual world, the demand for metaverse-related NFTs will increase, creating investment opportunities and increasing the value of NFTs.

The metaverse is usually accessed using digital avatars. These avatars are sold in the form of NFTs. You can play games, make friends, and even own land in the metaverse.

Investors can invest in the Bitwise Fund to gain exposure to the NFT index. Bitwise Fund is a passive index fund that tracks the performance of the Metaverse NFT Index.

How to Invest in an NFT Index

Investing in an NFT index involves the following steps:

Step 1: Set Up a Crypto Wallet

You need crypto to buy an NFT index. The purpose of the crypto wallet is to hold the cryptocurrencies to be used for buying the NFT index. You can use a software or hardware wallet to store your cryptocurrencies. You have many options when it comes to choosing a crypto wallet. Examples include MetaMask, Coinbase Wallet, WalletConnect, etc.

Step 2: Buy Cryptocurrency

You should buy the cryptocurrency that the NFT index is denominated in. Most NFTs index funds are denominated in ETH and other cryptocurrencies. You can purchase the crypto from a crypto exchange such as Coinbase via your credit card or bank transfer. You can then transfer it to the crypto wallet you have set up in the above step.

Step 3: Choose an NFT Index

There are many NFT index funds available in the market. Examples include the NFTX protocol, the Metaverse Index Fund, and others. Do your own research to know the best one for you.

Step 4: Buy the NFT Index

After choosing an NFT index fund, buy it using the crypto stored in your crypto wallet. The process of buying an NFT index fund will differ from one platform to another.

Step 5: Monitor your Investment

Just like any other investment, you should monitor your NFT index investment to ensure that it is performing according to your expectation. The performance of the NFT index fund can be tracked on the platform where you purchased it or on other market data websites.

Note that investing in NFTs and NFT index funds can be risky because NFTs are a relatively new asset class and they can be volatile. That’s why you should first understand the risks before investing.

Where Can I Buy NFT Indexes?

There are many platforms where NFT index funds can be bought. Examples include the following:

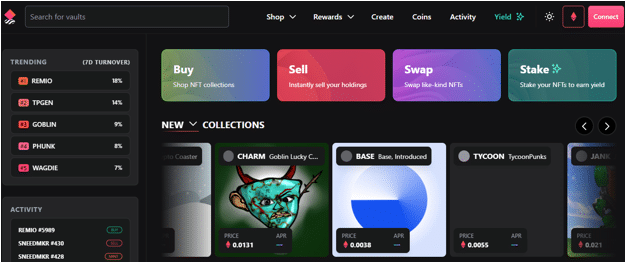

#1: NFTX

NFTX is a decentralized protocol where users can create and trade index funds on the Ethereum blockchain. You can use ETH or other cryptocurrencies to buy NFT indexes on the NFTX platform.

#2: Unifty

Unifty is a decentralized platform where you can create and trade NFT index funds. The platform also allows you to purchase NFT index funds using cryptocurrencies such as ETH.

#3: Metaverse Index Fund

The Metaverse Index Fund is offered by Bitwise Asset Management and it tracks the Metaverse Index Fund. The fund can be accessed by accredited investors and you can purchase it through select broker-dealers.

#4: Other Cryptocurrency Exchanges

Cryptocurrency exchanges such as Binance and FTX offer NFT index products that you can purchase via cryptocurrency.

Before choosing the platform, ensure that you do your own research to ensure it’s reputable, secure, and trustworthy.

What is the Average Price Index for NFTs?

It is hard to calculate the average price index of NFTs considering the fact that the NFT market is relatively new and is constantly evolving. NFT prices can vary widely based on a number of factors, such as the uniqueness and rarity of the NFT, the demand for the NFT, as well as the creator or artist behind the NFT.

However, websites such as CryptoSlam and NonFungible provide data about the average price of NFTs in various categories such as arts, gaming, and sports.

However, NFT prices can be very volatile and can fluctuate widely due to changes in various factors in the market.

Buy and Sell NFTs for a Profit

You can grow your crypto earnings by buying NFTs and selling them for a profit. NFTCrypto.io has made this even easier for you via their NFT signals trading system. They find profitable flips in the NFT market and share the signal with you in real-time. Join NFT Signals now and become a successful NFT trader. The platform users have so far earned a total group profit of over $1 Billion.