NFT trading has become a buzzword not only among those in the crypto community but also among artists and collectors. This has left many wondering how NFT trading works. If you are considering starting trading NFT, you’ve come to the right place. In this article, we have compiled everything that you need to learn about NFT trading. But first, let’s demystify the NFT technology.

What are NFTs?

NFTs have been around for some years, but they remain a mystery to many people. Hence, before learning NFT trading, it is good to have a good understanding of the technology.

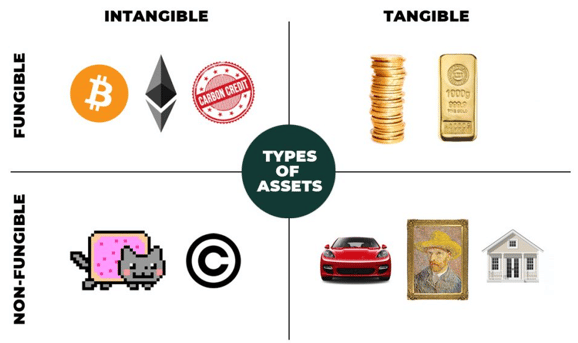

NFTs (Non-Fungible Tokens) are records of digital files with unique information that is stored on the blockchain. NFTs can be digital records of collectibles, artwork, sports, domain names, trading cards, and virtual property that can be traded on the blockchain.

It’s worth noting that NFTs are not an asset class but simply blockchain technology that validates the ownership of the digital item or commodity. Thus, you can view NFTs as certificates or deeds that show digital ownership of intangible assets that cannot be replicated.

The transactions are recorded on the blockchain, which serves as a public digital ledger for recording deals on the web, providing some transparency. The nature of the blockchain also ensures that NFTs are immutable.

NFT Trading: Fungible and Non-Fungible Items

Before venturing into NFT trading, it is worth grasping the meaning of these two terms: fungible vs non-fungible assets.

Non-fungible is a common term in economics used to describe an item with unique properties. This means that the item is not interchangeable.

A car is a good example of a non-fungible item.

The unique properties of one car make it very different from any other physical car.

The majority of the things in your house can also be good examples of non-fungible assets. Think of items such as a mattress, computer, and watch. They are all defined by their unique characteristics.

Fungible assets on the other hand are defined by their value, hence, they are interchangeable and cannot be distinguished from one another. For example, the currency is fungible because it can be exchanged for other items of equal value. For instance, you can exchange £1o for two £5 and remain with the same spending power. You will not have gained or lost value. Other examples of fungible commodities include grains and common shares in a company.

Why Invest in NFT Trade

NFTs have become one of the trendiest topics within the cryptocurrency space. Below are some of the reasons why you should invest in NFT trading:

#1: The NFT market is new

Although the NFT technology can be traced back to 2012, it became popular in 2021 after the artist Beeple sold a piece of art for $69 million. With NFTs being new to many cryptocurrency fans, early NFT traders will gain bountifully.

Venturing into NFT trading early will set you in a good position to reap rich perks in the future. The NFT hype is just getting started and more people are expected to join soon. This will also cause the value of NFTs to spike.

#2: Profit opportunity

A countless number of people have made a profit from NFT trading. In some cases, NFT tokens are handed out for free and their value grows as more people are added to the novelty of the assets. Investors in NFT trading have a strong chance of getting fair returns in the short and long term.

#3: Promoting content authenticity

NFTs enable content producers to tokenize their works without worrying about copyright. Investing in NFTs will give other artists confirmation that their works will be safe.

Why you should have a Strategy for Trading NFT

Trading NFT is now considered a profit-earning activity. However, before venturing into it, it is recommended that you create an NFT trading strategy to guide you in your NFT trade. The primary goal of trading any commodity or item is to help the trader earn profits, and failure to adopt an NFT trading strategy can restrict the amount of profit.

Having a strategy for trading NFT will give you a significant return on investment and guide you on how to approach your NFT trade deals. It will also keep you concentrated despite changes in the NFT market and help you to establish a roadmap for analyzing your performance.

How to Evaluate NFT Collectibles for Trading NFT

Evaluating NFTs is very critical in NFT trading. Since NFTs are new in the cryptocurrency industry, analyzing them can be challenging. The following are some of the factors that can help you to evaluate NFTs for NFT trade:

#1: Age of NFT

Although NFTs became popular in 2021, they have existed for many years and many NFT projects have withstood crypto-related storms over those years. NFT collectibles that existed before the industry became popular are considered more valuable than others.

#2: Scarcity

NFTs have diverse attributes, but NFTs with rarity is considered more valuable than others, hence, they are good for NFT trading. Purchasing such NFTs is more costly than buying a random item in the collection.

To learn how to find profitable NFT projects for NFT trading, read this.

#3: Background information on the NFT project

Before buying an NFT for NFT trade, you must do research to get the background information of the project. You should learn more about the project creators. Avoid NFT projects whose developers have dubious characters. Also, investigate other crypto-related projects that the team has created before and how they have performed in the market. This will help you avoid scams and rug pulls which are some of the challenges facing those in NFT trading.

Best NFT Trading Strategies

The purpose of trading NFT is to make huge profits. We have identified the top 5 NFT trading strategies to help you achieve that. They include the following:

#1: Buy the Floor

The popularity of NFTs is still rising and there is a high chance that they will exist for as long as feasible. That’s why one of the best strategies for NFT trade is to buy NFTs at the floor price. The floor price of an NFT is the lowest price of an NFT in a particular category.

However, don’t just buy an NFT just because it has a cheaper price. Instead, ensure that the NFT is within the category of your interest. Buying an NFT at its floor price will help you make more profit when its popularity and value rise in the future.

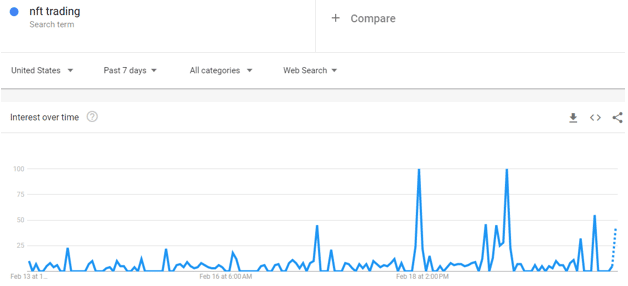

#2: Search for NFT’s Google Trend

Whether you are new to NFTs or not, it is easy to evaluate whether it is a popular niche by analyzing its Google trend.

Google trends gauges public sentiment about a particular subject or term. It scales the searches for a particular word between 0 and 100. This makes it a good tool for those seeking to venture into NFT trading. A high rating will be an indication that many people are becoming interested in the NFT trade and it is a good time to make a purchase. However, a low rating is an indication that it means that fewer people are showing interest, hence, you should be cautious.

#3: Purchase NFT collectibles with few sellers

This is our third NFT trading strategy. When an NFT collectible has many sellers, it means that selling it will be difficult unless you are interested in disposing of it at a cheap price. This may reduce NFT trading profits by a large margin. Thus, one of the best ways to make huge profit trading NFT is by buying and selling NFTs with fewer sellers.

#4: Value strategy

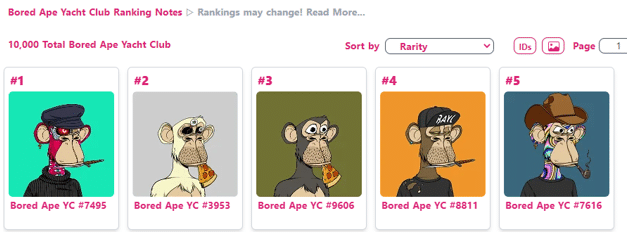

Buying NFTs considered desirable is a good strategy for trading NFT. You can use a tool such as rarity.tools to help you assess various NFT projects to know how uncommon they are over others.

Although 10,000 Bored Ape Yacht Club NFTs selling at high prices, the ones listed in the above picture are rare since they have traits that other apes in the collection don’t have.

An uncommon NFT collectible has a larger probability of growing in value because its demand will always be high than the supply. Thus, you should target such collectibles for NFT trading.

#5: Buy the Ceiling

Ceiling NFTs are costly, uncommon, and very popular items. They offer a good NFT trading opportunity for investors with loads of cash spare. Such NFTs have a high chance of growth, especially after celebrities or influencers get associated with them.

Ceiling NFTs are very costly, hence, only a few people can buy them. When the popularity of ceiling NFTs falls, traders may record huge losses since they may have to sell them at giveaway prices.

Buy and Sell NFTs for a Profit

You can grow your crypto earnings by buying cheap NFTs and selling them for a profit. NFTCrypto.io has made this even easier for you via their NFT trading signal system. They find profitable flips in the NFT market and share the signal with you in real-time. Join NFT Signals now and become a successful NFT trader. The platform users have so far earned a total group profit of over $1 Billion.