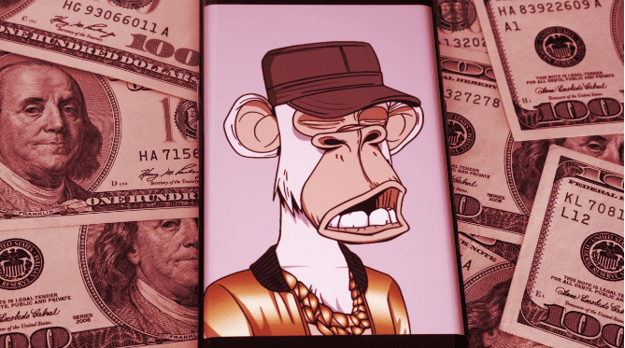

Cryptocurrency prices are down this week amid news of FTX facing a liquidity crisis and allegations of mismanagement of customer funds, and the market crisis may now be affecting NFTs. The price of the popular Bored Ape Yacht Club (BAYC) NFTs is sinking with the fall of ETH price. The BAYC NFT holders are now panicking and selling their valuable NFTs.

At the time of writing, NFT Floor Price data shows that the cheapest Bored Ape Yacht Club NFT, that is, the floor price, is listed for 57.5 ETH, which is equivalent to about $76,400. This translates to a 7% drop within 24 hours when measured in ETH. However, when measured in USD, it translates to a 24% decline in 24 hours, considering the declining value of ETH. ETH has fallen by 13% this week alone.

Considering the current price of Bored Apes in USD, the BAYC NFTs price has dropped from an all-time high of April this year of $429,000 (152 ETH), which came before Yuga Lab’s Otherside metaverse game launched the virtual land NFT deeds.

The floor price of the Bored Apes has remained neck-to-neck with that of CryptoPunks for a long time, another NFT project created by the Yuga Labs, but the Apes now seem to have lost pace.

At the time of writing, the CryptoPunks have a floor price of 66.75 ETH (or approximately $88,700), having risen by 6% in the last 24 hours. This means that many NFT investors will see the CryptoPunks as more durable assets capable of holding value than other NFTs in the market. The CryptoPunks have been stable since 2017.

NFTs (Non-Fungible Tokens) are digital assets stored on the blockchain and they represent the ownership of digital or even physical assets. The assets can be photographs, videos, artwork, or even profile pictures (PFPs). The Bored Ape Yacht Club is the most popular PFP NFT project, and it comprises 10,000 NFTs in the form of cartoon Apes. The BAYC NFTs have generated nearly $2.5 billion in secondary market sales since their launch in April 2021.

There are a number of factors that could have pushed the price of Bored Apes down this week. One of them is the despair in the cryptocurrency market following the collapse of FTX, which is forcing a significant percentage of investors to offload their “blue chip” NFTs. An on-chain action suggests this is happening.

Data collected by Flipside Crypto on Wednesday reveals that an increasing number of the leading NFT marketplace, OpenSea, is being done using Wrapped Ethereum (WETH) instead of the standard ETH. WETH trades have also increased this week, rising above 50% on Wednesday.

To bid on an NFT on OpenSea, you need WETH. The rising number shows that many NFT owners are accepting bids placed on their NFTs. The bids are below the market value of the NFTs, but NFT sellers are accepting low bids on their NFTs to liquidate them in fear of market mayhem.

Another reason behind the decline in the crypto market is BendDAO, a protocol that lends crypto loans to users using NFTs as collateral. The protocol is in the process of auctioning 14 BAYC NFTs from liquidated loans. The current bids on all 14 Bored Apes are below the floor price on many NFT marketplaces.