Do you want to know how to maximize your trading potential with Forex.com’s minimum deposit? If you’re interested in trading forex, one of the most important things you need to know is the minimum deposit requirement of your chosen forex broker. This requirement varies from broker to broker and can significantly impact your trading experience. In this article, we will be discussing the minimum deposit requirement of Forex.com, one of the leading forex brokers in the industry. We’ll explore the different types of accounts offered by Forex.com, the minimum deposit required for each account type, and the benefits of trading with this broker. By the end of this article, you’ll have a better understanding of the minimum deposit requirement of Forex.com and be able to make an informed decision on whether this broker is the right choice for you. So, let’s dive in and find out all the key information about Forex.com’s minimum deposit requirement for 2023.

What is Forex.com?

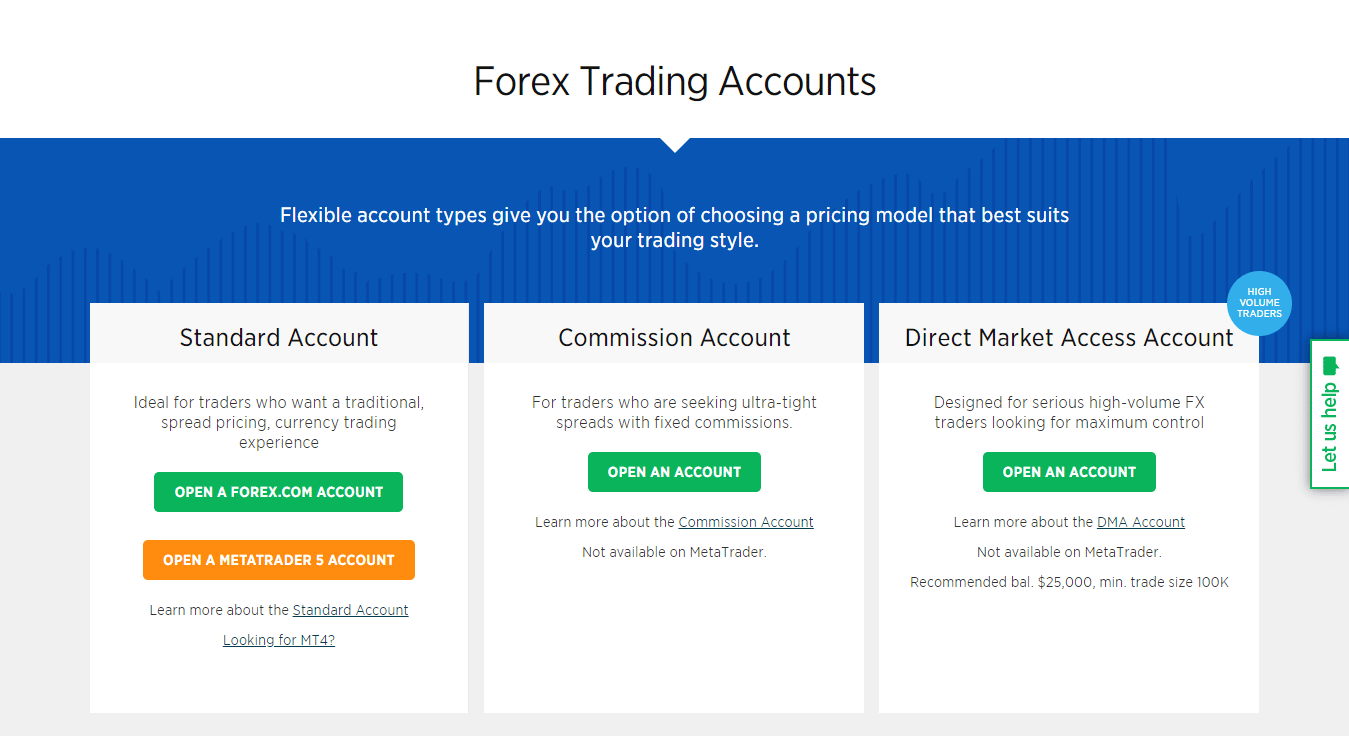

Popular online forex and CFD broker Forex.com was established in 2001. Leading financial regulators like the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC) oversee the company. It gives traders access to a variety of trading instruments, such as indices, cryptocurrencies, commodities, and forex. Forex.com offers both the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, as well as their own proprietary platform, called ForexTrader. The broker also provides a variety of educational resources and trading tools to help traders improve their skills and make informed trading decisions. One of the key considerations for traders when choosing a broker is the minimum deposit required to open an account. In the following sections, we will explore the minimum deposit requirements for Forex.com and the different account types available to traders.

Explore Our NFT Guides:

Forex.com’s Minimal Deposit

Forex.com requires a minimum deposit of $100 for clients to open a trading account. This is a standard minimum deposit requirement in the forex industry. However, there are different account types that require varying minimum deposits, such as the Premium Account, which requires a minimum deposit of $1,000, and the Pro Account, which requires a minimum deposit of $25,000.

It is important to note that the minimum deposit is not the only cost associated with trading with Forex.com. Traders also need to consider spreads, commissions, and other fees. The minimum deposit requirement may also vary depending on the trader’s location, as Forex.com operates in multiple jurisdictions with varying regulatory requirements.

Traders should carefully review and compare the account types and associated costs before opening an account with Forex.com. They should also consider their risk tolerance, trading strategy, and financial goals before making any investment decisions.

Deposit Options and Fees for Forex.com

Forex.com offers a variety of deposit options to suit different needs and preferences. The deposit options include bank wire transfer, credit/debit card, PayPal, Skrill, and Neteller. A bank wire transfer is a popular option, but it may take several days for the funds to be reflected in your account. Credit/debit card deposits are instant and convenient, but there may be limits on the amount you can deposit. PayPal, Skrill, and Neteller are e-wallet options that are fast and convenient, but they may have higher fees compared to other deposit options.

Forex.com does not charge any deposit fees, but you may incur fees from your chosen payment method. For example, credit/debit card deposits may have a processing fee of up to 3.5%. PayPal, Skrill, and Neteller may also have fees ranging from 2% to 5%.

Additionally, Forex.com requires a minimum deposit of $100 for its standard account and $10,000 for its DMA account. Forex.com also offers a range of account funding promotions, such as cash rebates and deposit bonuses, to encourage traders to deposit and trade more.

Related: Will Shiba Inu to Reach $1 or 50 cents?

How to Deposit Money on a Forex.com Account Step by Step

In general, deposit fees for Forex.com are relatively low and dependent on the deposit method you choose. Some deposit methods may also offer additional bonuses or incentives for making a deposit, so be sure to check for any promotions or special offers.

Follow these easy steps to deposit money into your Forex.com account:

- Access your account on Forex.com.

- Press the “Deposit Funds” button in the page’s upper right corner.

- Select the deposit method of your choice from the available options.

- Enter the deposit amount in your account currency.

- Follow the instructions to complete the deposit process.

- Once the deposit is complete, the funds will be credited to your account.

Conclusion

In conclusion, Forex.com is a popular trading platform for forex traders due to its reliable and secure services. The minimum deposit requirement of $100 is reasonable compared to other online brokers, and the availability of multiple deposit options makes it easy for investors to add funds to their accounts. It’s important to note the potential fees associated with deposit methods and to choose the most cost-effective option. Overall, Forex.com’s deposit process is straightforward and user-friendly, allowing traders to focus on making profitable trades. As with any investment, it’s essential to conduct thorough research and understand the risks before depositing any funds.

FAQs

-

Is there a fee for depositing funds on Forex.com?

Forex.com does not charge any deposit fees for credit/debit cards or e-wallets.

-

How long does it take after a deposit for money to show up in my Forex.com account?

The time it takes for funds to appear in your Forex.com account depends on the deposit method you choose.

-

Can I deposit funds in a different currency than my account currency?

Deposits on Forex.com can be made in a number of different currencies, including USD, EUR, GBP, and CAD.

Read our more Crypto Guides: