The U.S Securities and Exchange Commission (SEC) is investigating Yugas Labs Inc., the company that created the Bored Ape Yacht Club (BAYC) NFT collection.

According to Bloomberg, the probe seeks to establish whether the digital assets of the company should be regulated by the same rules used for securities such as stocks. Recently, a BAYC NFT holder lost 7 bored apes worth $700K.

Bored Ape Yacht Club NFTs Price and Sales Data

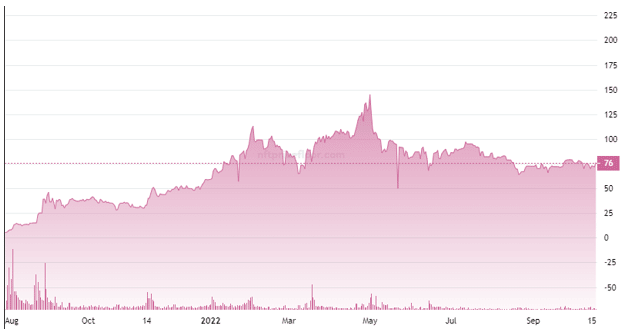

BAYC NFT has a price floor of 76 ETH and a 24-hour trading volume of 691.30 ETH with a total of 8 sales. The price floor of Bored Ape Yacht Club has risen by 5.98% in the last 24 hours.

The 7D average sale price for the NFT project is 78.976 ETH while the 7D highest sale price for the NFT is 140.00 ETH. The 7D lowest sale price for BAYC is 69.69 ETH. The Bored Ape Yacht Club is currently ranked #1 in terms of NFT price floor. It has a floor cap of 760,000 ETH, a listed ratio of 8.12%, and a maximum supply of 10,000.

ApeCoin, the native cryptocurrency of Yugas Labs is also under review. This crypto is normally given to the Bored Ape Yacht NFT owners. The value of the crypto dropped by 11% after the SEC investigation news broke. The agency is seeking to know how ApeCoins were distributed to holders of Mutant Ape Yacht Club, Bored Ape Yacht Club, and Bored Ape Kennel Club.

However, it is worth noting that SEC has not accused Yugas Labs of acting illegally and the probe doesn’t mean that SEC will file a lawsuit against Yugas Labs.

“It’s well-known that policymakers and regulators have sought to learn more about the novel world of web3,” a Yugas Labs spokesperson said. “We hope to partner with the rest of the industry and regulators to define and shape the burgeoning ecosystem,” the spokesperson continued. “As a leader in the space, Yuga is committed to fully cooperating with any inquiries along the way.”

The Yugas Labs investigation comes at a time when SEC is trying to impose its rules and regulations on the cryptocurrency market. In February, SEC hit at BlockFi, a crypto exchanges firm, for failure to register its sales. In March, the agency also called on companies to disclose information regarding their products.

To justify the crackdown, Gary Gensler, SEC chair, has cited laws and historical legal decisions. Financial transactions can be classified as “investment contracts” if an individual puts money into an asset while expecting to earn profit from it. According to Gensler, cryptocurrencies, NFTs, and other digital assets are securities.

The SEC’s investigation of Yugas Labs can be attributed to the great influence that the company has in the crypto and NFT industries. The Bored Ape Yacht club NFTs are the most valuable NFTs in the cryptocurrency market. Yugas Labs owns most of the top NFT collections, including BAYC, Meebits, and CryptoPunks. It also accounts for over 25% of the market cap for all NFT projects.